Tax brackets 2021 calculator

It is taxed at 10 which means the first 9950 of the money you made that year is taxed at 10. Your Federal taxes are estimated at 0.

Tax Calculator Estimate Your Income Tax For 2022 Free

Updated with 202223 ATO tax rates.

. Based on your projected tax withholding for the year we can also estimate your tax refund or. 0 would also be your average tax rate. The next six levels are.

There are seven federal tax brackets for the 2021 tax year. Up to 10 cash back TaxActs free tax bracket calculator is a simple easy way to estimate your federal income tax bracket and total tax. Estimate how much youll owe in federal taxes using your income deductions and credits all in just a few steps with our tax calculator.

Kenya PAYE Calculator with Income Tax Rates Of January 2022 Calculate KRA PAYE Net Pay NHIF and NSSF Contribution Ani Globe. Enter your filing status income deductions and credits and we will estimate your total taxes. Your bracket depends on your taxable income and filing status.

Use our calculator to estimate your 2021 taxable income for taxes filed in 2022. But as a percentage of your income your tax rate. 2021 Deductions and Exemptions Single Married Filing Jointly.

Estimate Your Taxes and Refunds Easily With This Free Tax Calculator from AARP. This BIR Tax Calculator helps you easily compute your income tax add up your monthly contributions and give you your total net monthly income. Use our US Tax Brackets Calculator in order to discover both your tax liability and your tax rates for the current tax season.

For the 2020 and 2021 tax years there are seven tax brackets. 10 12 22 24 32 35 and 37. The current tax rates 2017 consist of 10 15 25 28 33 35 and 396.

Use this simplified income tax calculator to work out your salary after tax. Ad Enter Your Status Income Deductions and Credits and Estimate Your Total Taxes. Calculate your income tax bracket 2021 2022.

In 2021 the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows Tables 1. Your tax bracket is the rate you pay on the last dollar you earn. To lower the amount you owe the simplest way is to adjust your tax withholdings on your W-4.

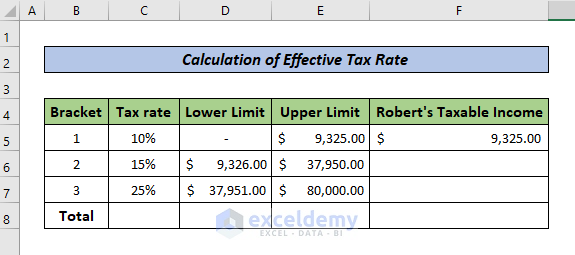

2021 capital gains tax calculator. For example in the 2021 tax season if you earn 80000 you will be in the 49020 to 98040 tax bracket with a tax rate of 205. Interest income can also be subject to another tax called the Net Investment Income Tax NIIT.

Where they apply how to calculate them. 2021 Federal Income Tax Brackets and Rates. The NIIT is a 38.

Tax Bracket Calculator Knowing your tax bracket can help you make better financial decisions. This is 0 of your total income of 0. 2022 capital gains tax rates.

Your 2021 taxable income - versus tax free income - will be taxed at different IRS income tax brackets or rates based on income tax brackets by tax year and your personal tax return filing. Effective tax rate 172. The lowest tax bracket or the lowest income level is 0 to 9950.

These are the rates for. Our W-4 Calculator can help you determine how to update your W-4 to get your desired tax. The Tax Caculator Philipines 2022 is.

Year 2021-2022 Weekly Fortnightly Monthly Annually. In 2021 and 2022 the capital gains tax rate is 0 15 or 20 on most assets held for longer than a year. This means that you are taxed at 205 from.

The 2021 Tax Calculator uses the 2021 Federal Tax Tables and 2021 Federal Tax Tables you can view the latest tax tables and historical tax tables used in our tax and salary calculators here.

Income Tax Calculator For Fy 2019 20 Fy 2020 21 Eztax In Help

6 75 Sales Tax Calculator Template Tax Printables Sales Tax Tax

Fy 19 20 Income Tax Return E Filing Exemptions Deductions E Payment Refund And Excel Calculator Only 30 Second Income Tax Return Income Tax Tax Reduction

Income Tax Calculator 2021 2022 Estimate Return Refund

Federal Income Tax Calculator Find Your Irs Refund Payment For Your Return

80 000 Income Tax Calculator New York Salary After Taxes Income Tax Payroll Taxes Salary

How To Calculate Federal Income Tax

Income Tax Calculator Estimate Your Refund In Seconds For Free

Income Tax Bracket Calculator Income Tax Brackets Tax Brackets Filing Taxes

What Is My Tax Bracket 2021 2022 Federal Tax Brackets Forbes Advisor

Excel Formula Income Tax Bracket Calculation Exceljet

How To Calculate Federal Tax Rate In Excel With Easy Steps

Inkwiry Federal Income Tax Brackets

.jpg)

Income Tax Calculator Estimate Your Refund In Seconds For Free

Fy 19 20 Income Tax Return E Filing Exemptions Deductions E Payment Refund And Excel Calculator Only 30 Second Income Tax Return Income Tax Tax Return

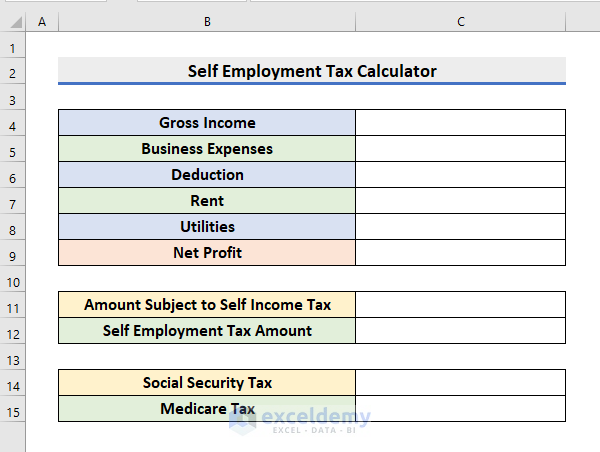

Self Employment Tax Calculator In Excel Spreadsheet Create With Easy Steps

Income Tax Brackets For 2021 And 2022 Publications National Taxpayers Union