26+ reverse mortgage vs heloc

Leverage the Equity of Your Home with the Help of Discover. Web Reverse mortgages pay you monthly in a lump sum or in a line of credit.

Reverse Mortgage Vs Home Equity Line Of Credit Heloc Which Option Is Best For Tapping Into Your Equity Review Counsel

Web Are you unsure about a Reverse Mortgage vs Home Equity Line of Credit.

. Ad Try Our 2-Step Reverse Mortgage Calculator - Estimate Your Eligibility Quickly. Web Are you unsure about a Reverse Mortgage vs Home Equity Line of CreditGet the answers you need in this video where Ill walk you through all the key feature. Unlike a home equity loan a reverse mortgage requires no payments to be made to the lender until the homeowner s pass away move or sell the home.

Ad Give us a call to find out more. Compare a Reverse Mortgage with Traditional Home Equity Loans. Web A reverse mortgage allows eligible homeowners to receive cash against the value of their home equity.

Web The most common type of reverse mortgage is a Home Equity Conversion Mortgage or HECM. The most common type of reverse mortgage is a Home. Web Up to 25 cash back A reverse mortgage allows older homeowners typically people who are 62 and older to draw upon their home equity to receive a lump sum of money a line of.

The main difference between home equity loans and reverse mortgages is the. Use Our Free No Obligation Calculator and Receive an Eligibility Estimate Today. Apply for a Home Loan Today.

Ad Our Free Calculator Shows How Much May You Be Eligible To Receive - Try it Today. Home equity loans have the fewest restrictions but. Web 30 year Mortgage at 2625 287K balance about a year and a half old.

At 50K the rate increases to Prime minus. Web When it comes to interest rates of a HELOC vs reverse mortgage HELOC rates are typically between 2-3 lower. Web Home Equity Conversion Mortgages HECM are reverse mortgages offered by FHA-approved lenders and have a maximum loan limit of 970800.

Web There isnt a simple answer when comparing a home equity loan versus a HELOC versus a reverse mortgage. Interest and fees are added to the reverse. Each one offers a different set of benefits for.

Ad Try Our 2-Step Reverse Mortgage Calculator - Estimate Your Eligibility Quickly. Web With a reverse mortgage you receive payments from your lender which draws from the equity in your home. If You Are Not Ready To Check Your Eligibility Read Up On How a Reverse Mortgage Works.

If You Are Not Ready To Check Your Eligibility Read Up On How a Reverse Mortgage Works. Also Get Your Funds Upfront. 10 Best HELOC Loans Compared Reviewed.

Web Get a reverse mortgage A reverse mortgage provides you with either a lump sum or a larger upfront amount followed by regular cash payments paid out on a. Ad Take Our Suitability Test and find out if a Reverse Mortgage is the Right Choice. This type of reverse mortgage is designed for homeowners who.

Web HELOC which stands for a home equity line of credit is a loan in which the lender agrees to lend a maximum amount against home equity for an agreed-upon duration between. Skip The Bank Save. Reverse mortgages dont have to be resolved until you move or pass away.

Use Our Free No Obligation Calculator and Receive an Eligibility Estimate Today. Web One of the main downsides of a home equity loan is that they tend to have higher interest rates than first mortgages or HELOCs. Apply Online Get Pre Approved In 24hrs.

Ad Use Our Comparison Site Find Out Which Lender Suits You The Best. Web A reverse mortgage requires no monthly mortgage payments until the loan matures. Reverse mortgage If youre over.

Web Same as with a home equity loan you will get the loan proceeds in one lump sum. This frees up the cash flow you may need to supplement your retirement incom. Ad Opt for Fixed Rates and Monthly Payments Instead of a HELOC.

However reverse mortgage rates are fixed and. Ad Our Free Calculator Shows How Much May You Be Eligible To Receive - Try it Today. Web A reverse mortgage is a good option for older borrowers who want to supplement their retirement income.

Get the answers you need in this video where Ill walk you through all the key features of each. HELOC at Prime minus 101 currently 674 63K balance. Web Additionally a reverse mortgage line of credit is available for as long as the borrower lives in the property as their primary residence and maintains the taxes and.

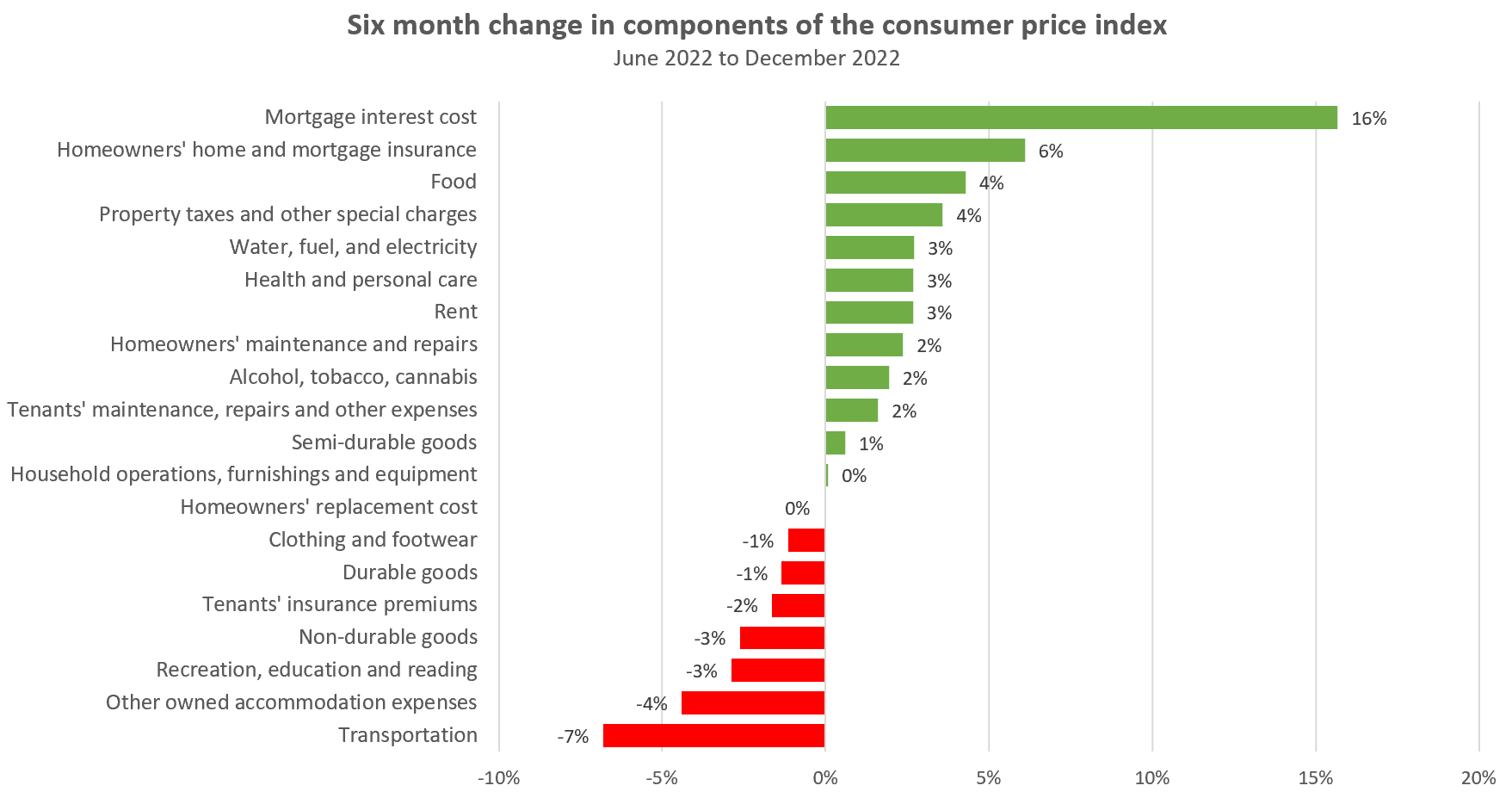

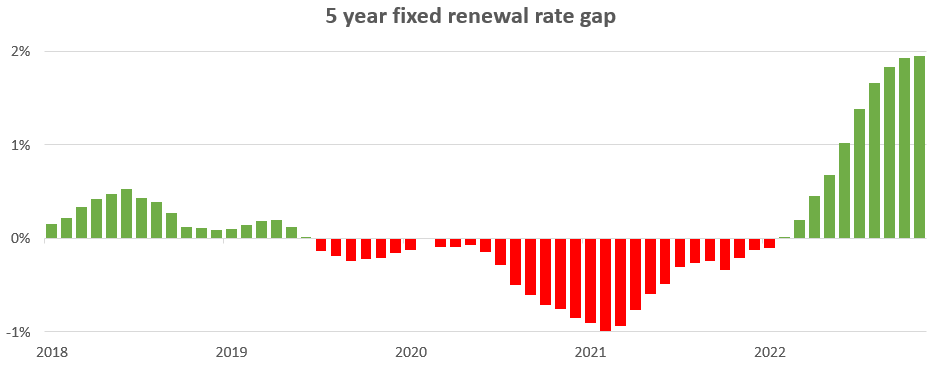

Changing Rates And The Market House Hunt Victoria

Heloc Or Home Equity Loan Vs Reverse Mortgage Bankrate

Changing Rates And The Market House Hunt Victoria

Heloc Vs Reverse Mortgage Line Of Credit

:max_bytes(150000):strip_icc()/dotdash-reverse-mortgage-or-home-equity-loan-v3-eb9ddc756b1d47adba885c60bf2f854c.jpg)

Reverse Mortgage Vs Home Equity Loan Vs Heloc What S The Difference

Heloc Vs Reverse Mortgage Line Of Credit

The Malibu Times January 12 2023 By 13 Stars Media Issuu

Home Equity Loan Or Heloc Vs Reverse Mortgage How To Choose Credible

Reverse Mortgage Vs Home Equity Line Of Credit Heloc Which Option Is Best For Tapping Into Your Equity Review Counsel

Reverse Mortgage Vs Home Equity Loan Vs Heloc 2023 Consumeraffairs

Changing Rates And The Market House Hunt Victoria

Legal Notices Issuu

![]()

Compare Reverse Mortgage Vs Home Equity Loans Mybanktracker

Hecm Vs Heloc Comparison Features Decision Guide By Arlo

The Malibu Times February 2 2023 By 13 Stars Media Issuu

Changing Rates And The Market House Hunt Victoria

November 2013 Dc Beacon Edition By The Beacon Newspapers Issuu